An All-in-One Medical Coverage for You and Your Family

Note:

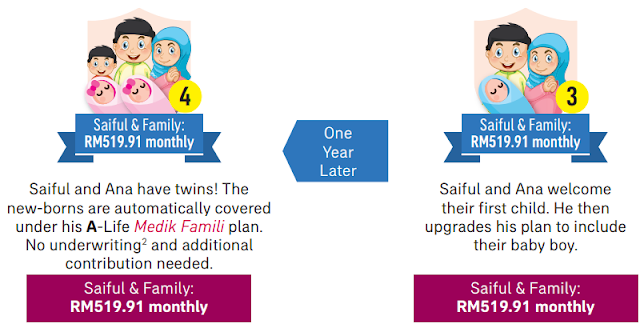

1. The above example is based on male, non-smoker, entry age at 23 years old and has standard health.

2. Provided that the babies are registered with AIA PUBLIC Takaful Bhd. within 90 days after birth.

3. The Family plan provides coverage for maximum of 4 dependent children under one plan.

What is Takaful Insurance?

Takaful is a mutual assistance scheme based on the principles of solidarity, brotherhood, and cooperation. Each participant agrees to contribute based on Tabarru‘ (donation) into a fund,

namely the Participants’ Risk Fund (PRF), which will be used to assist each other in times of

need. AIA PUBLIC Takaful Bhd. (AIA PUBLIC) as a Takaful Operator is entrusted to invest and

manage this fund in accordance with Shariah-compliant investment strategy.

What is A-Life Medik Famili?

A-LifeMedik Famili is a standalone medical and health Takaful plan that provides comprehensive coverage on medical and hospitalisation coverage. Its value proposition allows you to extend the

same coverage to your spouse and/or children.

Who is eligible to participate in A-Life Medik Famili?

How will the family members be covered by A-Life Medik Famili?

Family members who are included in the A-Life Medik Famili plan will enjoy the same benefits

as the Participant for the same contribution amount. This means each person will effectively

enjoy individual coverage protection for the same contribution amount, which makes this plan

good value-for-money to protect and cover the family.

If one of my children is hospitalised and claims under this plan, will this affect the coverage

for my spouse and other children?

The unique benefit of A-Life Medik Famili is that each person covered under the plan enjoys

their own individual protection, yet you only contribute the same contribution amount as you do

towards your own coverage protection.

What is Deductible?

Deductible is a fixed amount of RM300 that must be paid by the Person Covered or Covered

Member per Disability before any Hospitalisation and Surgical Benefits are payable by the

Takaful Operator

Will I get to enjoy the plan’s coverage when travelling overseas?

Other than Singapore and Brunei, we are not able to cover any medical treatment that you incur outside of Malaysia, if you reside or travel overseas for more than 90 consecutive days. If you are eligible to receive the benefit, the coverage amount is subject to reasonable and customary charges for the same treatment in Malaysia.

Will my contributions increase as my age increases?

Yes. The contributions payable will depend on your attained age when the contributions are due.

Are my contributions guaranteed?

Your contributions are not guaranteed and the AIA PUBLIC reserves the right to revise the contributions by giving 30 days prior written notice

What is the term of contributions for A-Life Medik Famili?

The Person Covered will need to pay his/her contributions up to the attained age of 100 years old. Contributions can be paid annually, half-yearly, quarterly or monthly, according to available payment methods.

Do I get to enjoy Surplus?

Surplus will be determined and declared, if any, at least once a year by the AIA PUBLIC. If there is any Surplus arising from the PRF, the net Surplus, after claims payable and required reserves shall be shared by the company and Participant at the following ratios:

Are contributions paid for A-Life Medik Famili eligible for income tax relief?

Contributions paid for this plan may qualify you for a personal tax relief of up to RM3,000 for medical and education plan, subject to the Malaysian Inland Revenue Board.

You can LIVE WELL by proactively taking care of your health, PROTECT WELL by having adequate coverage against unexpected medical expenses and GET WELL by receiving prompt and quality services. With our plan, you can have peace of mind, knowing that you’re protected from the financial burden of rising medical costs. Contact me for free consultation

No comments:

Post a Comment